Main Difference

The main difference between Amortization and Depreciation is that the Amortization is a Wikimedia disambiguation page and Depreciation is a allocating the cost of a (tangible) asset over a period of time.

-

Amortization

Amortisation (or amortization; see spelling differences) is paying off an amount owed over time by making planned, incremental payments of principal and interest. To amortise a loan means “to kill it off”. In accounting, amortisation refers to charging or writing off an intangible asset’s cost as an operational expense over its estimated useful life to reduce a company’s taxable income.

-

Depreciation

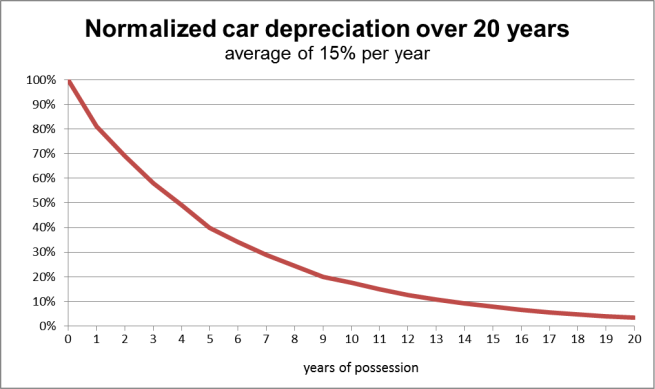

In accountancy, depreciation refers to two aspects of the same concept: first, the actual decrease in value of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used (depreciation with the matching principle).Depreciation is thus the decrease in the value of assets and the method used to reallocate, or “write down” the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes.The decrease in value of the asset affects the balance sheet of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the income statement that they report. Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used.

Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500.

Depreciation has been defined as the diminution in the utility or value of an asset, and is a non cash expense. It does not result in any cash outflow; it just means that the asset is not worth as much as it used to be. Causes of depreciation are natural wear and tear.

-

Amortization (noun)

The reduction of loan principal over a series of payments.

-

Amortization (noun)

The distribution of the cost of an intangible asset, such as an intellectual property right, over the projected useful life of the asset.

-

Depreciation (noun)

The state of being depreciated; disparagement.

-

Depreciation (noun)

The decline in value of assets.

-

Depreciation (noun)

The measurement of the decline in value of assets. Not to be confused with impairment, which is the measurement of the unplanned, extraordinary decline in value of assets.